The regulation for board diversity is now in full effect for companies listed on Nasdaq. Here are the essential details:

- Diversity Requirement: Nasdaq-listed entities are required to have at least one board member who is a woman, identifies as LGBTQ+, or is an “underrepresented minority.” Companies unable to meet this requirement must publicly explain why.

- Legal Status: The diversity rules stand firm despite appeals against them. The Fifth Circuit Court has maintained the SEC’s endorsement of Nasdaq’s diversity requirements, with the rules in active enforcement.

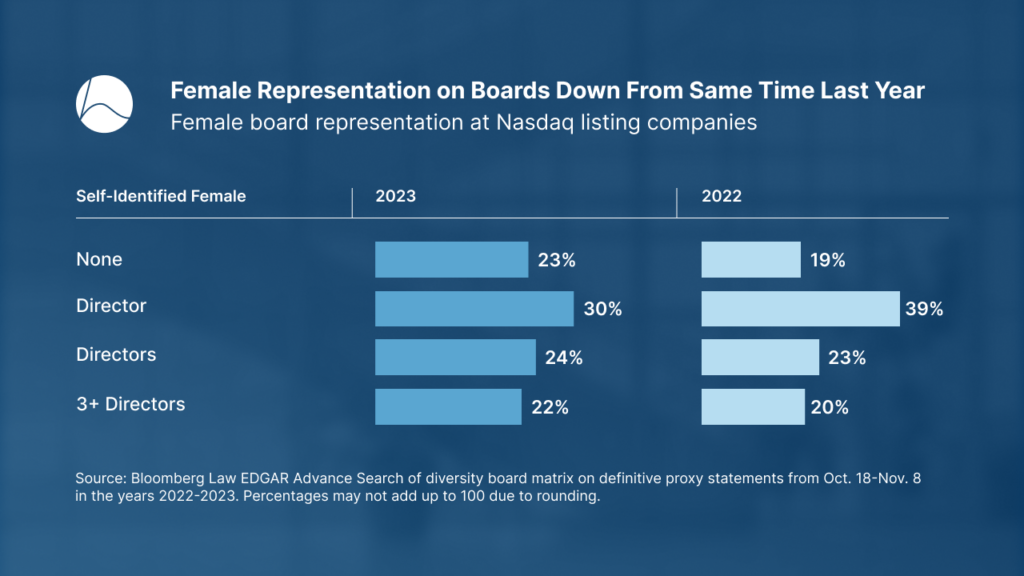

- Disclosures So Far: Companies started reporting their board diversity statistics in 2022. The initial data indicates a modest decline in the representation of women and minority or LGBTQ+ directors.

- Prospective Rules: By the close of 2025, larger companies are expected to have a minimum of two diverse directors, with smaller firms given until the end of 2026 to comply. Some companies may meet the criteria with two female directors, contingent on certain financial metrics.

- Rule’s Outlook: While the rule is presently binding, the possibility of a review by the full Fifth Circuit Court could lead to future alterations.

With this new rule in action, evaluating companies becomes essential, especially considering that at least one-fifth of Nasdaq-listed companies will be subject to immediate changes in their board composition.

Harmony Analytics provides detailed insights into an organization’s workforce demographics, empowering capital owners and managers to effectively benchmark and evaluate portfolio adherence to regulatory standards. Please get in touch with our team to learn more about how Harmony’s analytics can improve your portfolio analysis capabilities.